The smart Trick of Custom Private Equity Asset Managers That Nobody is Discussing

Wiki Article

About Custom Private Equity Asset Managers

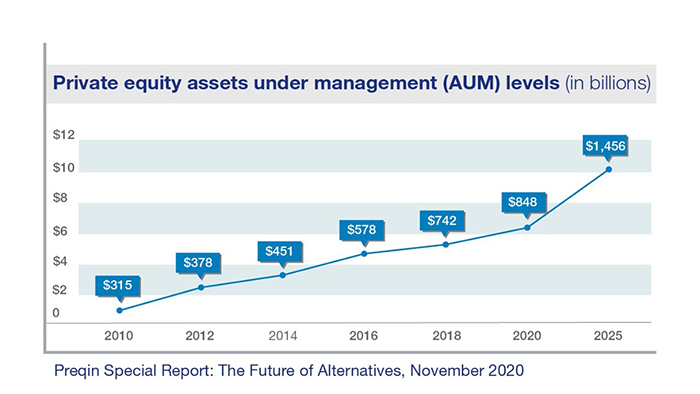

You have actually probably heard of the term exclusive equity (PE): investing in companies that are not publicly traded. About $11. 7 trillion in properties were taken care of by personal markets in 2022. PE firms look for opportunities to make returns that are far better than what can be achieved in public equity markets. There may be a few things you don't recognize concerning the industry.

Private equity companies have a variety of financial investment preferences.

Because the most effective gravitate towards the bigger deals, the center market is a dramatically underserved market. There are more sellers than there are very experienced and well-positioned finance experts with considerable buyer networks and resources to take care of a bargain. The returns of personal equity are commonly seen after a few years.

Excitement About Custom Private Equity Asset Managers

Traveling listed below the radar of big international companies, much of these little business often give higher-quality customer solution and/or niche services and products that are not being offered by the large conglomerates (https://www.imdb.com/user/ur173700848/?ref_=nv_usr_prof_2). Such upsides attract the passion of exclusive equity companies, as they possess the insights and wise to manipulate such chances and take the company to the following level

Many supervisors at portfolio companies are offered equity and perk settlement structures that award them for striking their financial targets. Personal equity possibilities are often out of reach for people that can't spend millions of dollars, however they should not be.

There are guidelines, such as restrictions on the check this site out accumulation quantity of money and on the number of non-accredited capitalists. The exclusive equity organization brings in a few of the finest and brightest in corporate America, consisting of top entertainers from Fortune 500 business and elite monitoring consulting companies. Law office can also be hiring grounds for personal equity employs, as accountancy and lawful skills are necessary to full deals, and purchases are very demanded. https://filesharingtalk.com/members/589221-cpequityamtx.

The Facts About Custom Private Equity Asset Managers Uncovered

One more disadvantage is the lack of liquidity; as soon as in a personal equity purchase, it is not simple to get out of or market. With funds under management currently in the trillions, private equity companies have come to be appealing financial investment cars for well-off individuals and establishments.

For decades, the characteristics of personal equity have actually made the asset course an appealing proposal for those that might get involved. Since access to personal equity is opening as much as more specific capitalists, the untapped potential is ending up being a fact. So the question to think about is: why should you spend? We'll start with the major arguments for purchasing personal equity: Just how and why exclusive equity returns have historically been greater than other possessions on a variety of degrees, Just how consisting of private equity in a portfolio impacts the risk-return account, by helping to expand versus market and cyclical risk, After that, we will certainly outline some crucial factors to consider and dangers for exclusive equity investors.

When it concerns introducing a brand-new property right into a profile, the many basic factor to consider is the risk-return account of that possession. Historically, private equity has actually displayed returns similar to that of Arising Market Equities and greater than all other traditional property courses. Its relatively reduced volatility combined with its high returns produces a compelling risk-return account.

Facts About Custom Private Equity Asset Managers Revealed

Actually, private equity fund quartiles have the widest variety of returns across all different possession classes - as you can see below. Method: Internal rate of return (IRR) spreads computed for funds within vintage years separately and afterwards balanced out. Median IRR was calculated bytaking the average of the typical IRR for funds within each vintage year.

The takeaway is that fund option is critical. At Moonfare, we bring out a rigorous choice and due diligence procedure for all funds provided on the platform. The impact of including private equity right into a profile is - as constantly - dependent on the profile itself. A Pantheon study from 2015 suggested that including exclusive equity in a portfolio of pure public equity can open 3.

On the other hand, the best private equity firms have access to an even larger swimming pool of unidentified chances that do not encounter the same examination, along with the sources to carry out due diligence on them and identify which deserve spending in (TX Trusted Private Equity Company). Spending at the ground floor suggests greater risk, however, for the companies that do prosper, the fund take advantage of greater returns

More About Custom Private Equity Asset Managers

Both public and private equity fund managers commit to spending a percent of the fund but there stays a well-trodden issue with aligning passions for public equity fund monitoring: the 'principal-agent problem'. When a capitalist (the 'primary') works with a public fund supervisor to take control of their resources (as an 'agent') they delegate control to the supervisor while maintaining ownership of the possessions.

In the instance of private equity, the General Companion does not simply gain a monitoring cost. They additionally gain a percent of the fund's earnings in the type of "bring" (normally 20%). This makes sure that the rate of interests of the supervisor are lined up with those of the capitalists. Exclusive equity funds likewise alleviate an additional form of principal-agent problem.

A public equity capitalist eventually desires one thing - for the management to boost the stock price and/or pay returns. The financier has little to no control over the decision. We revealed above just how many exclusive equity approaches - particularly majority buyouts - take control of the operating of the company, making certain that the lasting value of the company comes initially, rising the roi over the life of the fund.

Report this wiki page